Unlock Your Prospective with Expert Loan Services

Unlock Your Prospective with Expert Loan Services

Blog Article

Select From a Range of Funding Providers for Personalized Financial Assistance

When it comes to looking for monetary assistance, the selection of financing services offered can be frustrating yet critical in protecting customized assistance. By checking out these varied lending services, people can unlock opportunities for personalized monetary support that align with their objectives and circumstances.

Finance Options for Debt Combination

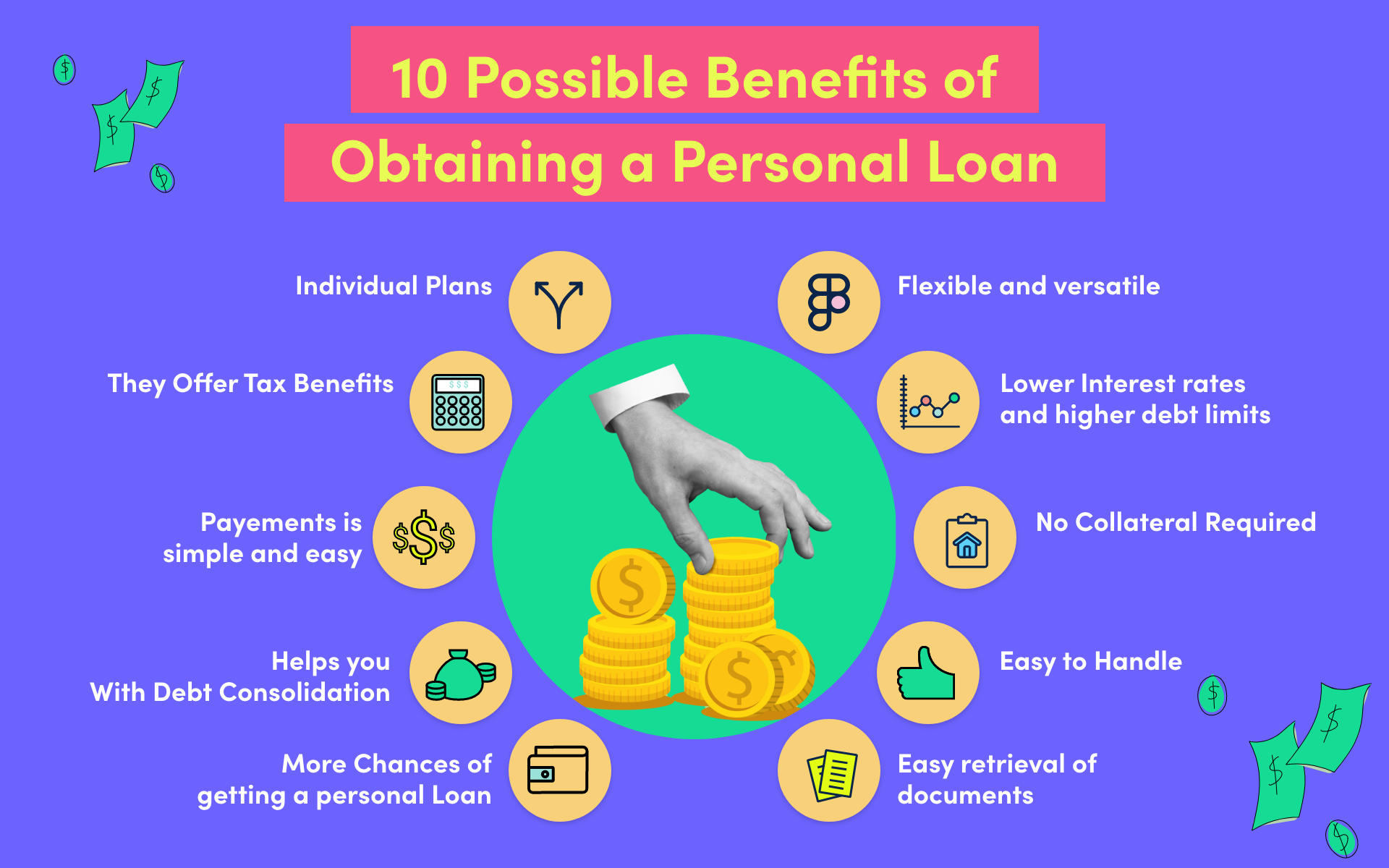

Financial debt debt consolidation offers a possibility for individuals to improve their economic obligations right into a single manageable settlement strategy. When thinking about financing options for financial debt loan consolidation, people have several opportunities to check out. One common alternative is a personal finance, which enables debtors to combine several debts into one financing with a dealt with month-to-month payment and passion price. Personal fundings are unprotected, implying they do not require security, making them accessible to a vast range of consumers.

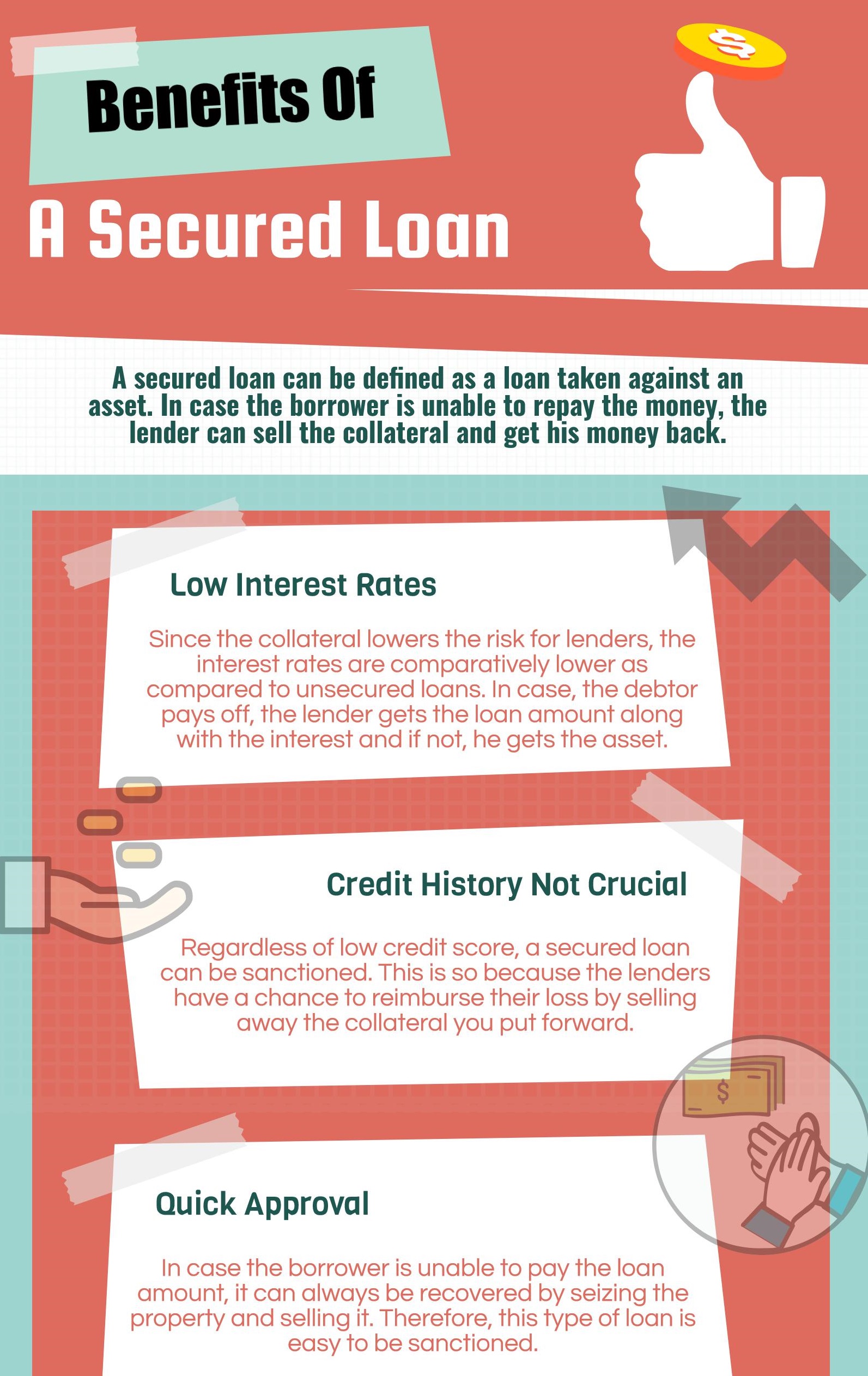

One more alternative is a home equity loan or a home equity line of credit rating (HELOC), which makes use of the customer's home as collateral. These financings normally have reduced interest prices compared to personal loans yet featured the risk of losing the home if payments are not made. Equilibrium transfer bank card are additionally a preferred choice for debt combination, supplying an initial period with low or 0% rate of interest on moved equilibriums. It is essential to thoroughly take into consideration the terms and charges linked with each option prior to making a decision on the most appropriate financing for debt combination.

Personal Lendings for Huge Acquisitions

Recommending on financial choices for substantial purchases usually involves thinking about the choice of utilizing personal loans. Loan Service (mca lenders). When encountering considerable costs such as purchasing a brand-new car, moneying a home improvement project, or covering unexpected clinical expenses, personal loans can give the essential financial backing. Personal lendings for big acquisitions offer individuals the versatility to borrow a particular amount of money and settle it in dealt with installments over an established period, usually varying from one to 7 years

One of the crucial advantages of individual financings for considerable procurements is the capacity to access a swelling sum of money upfront, permitting people to make the wanted acquisition quickly. Additionally, personal financings often include affordable passion rates based on the consumer's creditworthiness, making them an affordable funding option for those with good credit history. Before choosing a personal finance for a large acquisition, it is vital to assess the terms used by different lending institutions to secure the most favorable deal that straightens with your economic objectives and repayment abilities.

Emergency Situation Funds and Cash Advance Loans

When dealing with an economic emergency situation, individuals should check out different choices such as discussing settlement strategies with financial institutions, looking for assistance from neighborhood charities or federal government programs, or loaning from loved ones before considering payday finances. Developing an emergency fund gradually can likewise help minimize the need for high-cost loaning in the future.

Specialized Fundings for Certain Requirements

When looking for economic support customized to one-of-a-kind circumstances, individuals may explore specific funding alternatives designed to address particular needs efficiently. These specialized loans deal with various situations that require tailored economic remedies past traditional offerings. As an example, medical financings are tailored to cover healthcare costs not completely covered by insurance coverage, supplying individuals with the required funds for treatments, surgical treatments, or clinical emergencies. Pupil loans use particular terms and benefits for academic purposes, aiding students fund their studies and relevant costs without frustrating monetary burden.

Moreover, home remodelling financings are developed for home owners looking to upgrade their homes, offering practical settlement strategies and competitive rate of interest rates for redesigning tasks. In addition, small company finances provide to business owners looking for capital to begin or increase their endeavors, with specialized terms that align with the special demands of organization operations. By discovering these specialized car loan alternatives, people can locate tailored financial services that meet their particular demands, providing them with the necessary support to achieve their goals properly.

Online Lenders for Quick Authorization

For expedited loan approval procedures, people can transform to on the internet loan providers who provide swift and convenient financial solutions. Online lenders have actually changed the loaning experience by improving the application process and offering quick authorizations, occasionally within mins. These lending institutions typically offer a large range of finance choices, including individual finances, payday advance, installment loans, and credit lines, satisfying diverse financial demands.

One of the vital advantages of online lending institutions is the speed at which they can refine funding applications. By leveraging technology, these lending institutions can evaluate a person's credit reliability promptly and make financing decisions quickly. This efficiency is specifically advantageous for those that require prompt access to funds for emergency situations or time-sensitive expenses.

Additionally, online loan providers often have much less rigorous eligibility standards contrasted to traditional monetary establishments, making it simpler for people with varying debt profiles to protect a loan. This availability, incorporated with the quick authorization procedure, makes online loan providers a preferred selection for many seeking quick and convenient financial support.

Conclusion

In verdict, individuals have a range of finance choices offered to address their financial needs. It is important for people to meticulously consider their alternatives and select the funding service that best fits their needs.

Report this page